Fixed vs Variable Mortgage Rates in Dubai: Which Is Better?

Choosing between a fixed vs variable mortgage is one of the most important decisions when buying property in Dubai. The right choice can bring long-term financial confidence, while the wrong one may create uncertainty over time. Dubai’s mortgage market offers flexible, well-regulated home financing options designed for both residents and expats. Understanding how fixed and variable rates work within the UAE context helps buyers make informed decisions aligned with their financial goals.

This guide explains the differences clearly, without complexity, so you can decide which mortgage structure suits your lifestyle and plans best.

Understanding Mortgage Rates in Dubai

Mortgage rates in Dubai are influenced by several transparent and regulated factors, including:

1. The Emirates Interbank Offered Rate (EIBOR)

2. UAE Central Bank monetary policy

3. Loan tenure and loan-to-value (LTV) ratio

4. Borrower profile and income stability

Banks across the UAE offer both fixed and variable structures, allowing buyers to choose flexibility or payment predictability based on preference. If you are still deciding between fixed and variable options, our detailed guide on mortgage types in Dubai explains how each structure works and which option may suit your financial goals.

For buyers who want expert guidance throughout the process, our mortgage finance services in Dubai provide end-to-end support, from eligibility checks to lender comparisons and final approvals.

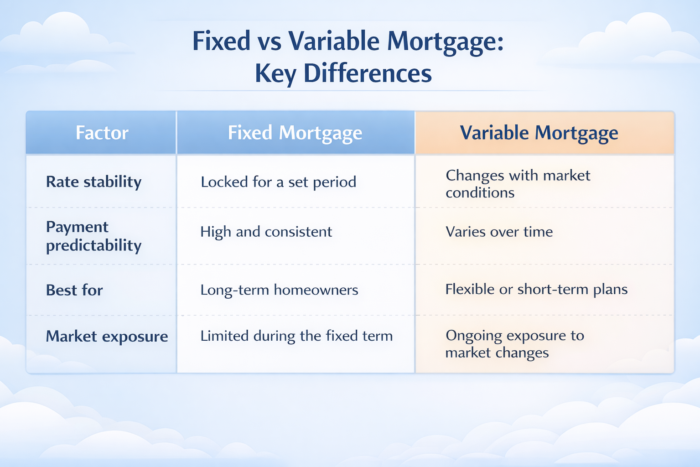

What Is a Fixed Mortgage Rate?

A fixed mortgage rate in Dubai means your interest rate remains unchanged for a specific period, usually between 1 to 5 years.

Benefits of a Fixed Rate Mortgage

a. Predictable monthly payments

b. Easier financial planning

c. Protection from short-term market changes

This option is commonly preferred by first-time buyers and homeowners who value consistency.

After the fixed period ends, the mortgage typically transitions to a variable rate based on market benchmarks.

What Is a Variable Mortgage Rate?

A variable mortgage rate in Dubai fluctuates over time and is usually linked to EIBOR plus a margin.

Benefits of a Variable Rate Mortgage

a. Potentially lower starting rates

b. Flexibility for refinancing or early settlement

c. Suitable for short- to medium-term property plans

Variable rates are often chosen by experienced buyers or investors to be comfortable with market movements.

Understanding these differences helps align your mortgage choice with your future expectations.

Which Mortgage Option Works Best in Dubai?

There is no universal answer to whether fixed or variable is better. The right choice depends on your personal situation.

Fixed Rate May Suit You If:

a. You want stable monthly payments

b. You plan to live in the property long term

c. You prefer financial predictability

Variable Rate May Suit You If:

a. You expect changes in income or property plans

b. You may sell or refinance early

c. You are comfortable with market-linked adjustments

Both options are widely available across Dubai mortgage providers, offering structured flexibility rather than rigid limitations.

Understanding the Role of EIBOR

Many variable mortgages in the UAE are tied to EIBOR, a transparent benchmark published under regulatory oversight.

For accurate, official reference, buyers can review rate information directly from the UAE Central Bank.

Why Comparing Mortgage Options Matters?

Dubai’s mortgage landscape is diverse, and offers may vary based on loan structure, tenure, and eligibility.

Instead of focusing only on headline rates, buyers should consider:

a. Reversion rates after fixed periods

b. Early settlement conditions

c. Overall repayment cost

To better understand how these factors affect your monthly payments and long-term costs, using a Dubai mortgage calculator can be extremely helpful. It allows you to compare fixed and variable options, estimate repayments based on loan tenure, and see how changes in interest rates may impact your budget before making a final decision.

Fixed vs Variable Mortgage for Expats in Dubai

Expats purchasing property in Dubai often benefit from flexible mortgage solutions designed for international income structures. Both fixed and variable options are available, with loan terms adjusted to residency status and property value. Understanding payment requirements and future refinancing options is especially important for non-resident buyers.

Final Thoughts: Making the Right Mortgage Choice

Choosing between a fixed vs variable mortgage in Dubai is not about selecting a better product but selecting the right fit.

Dubai’s well-regulated mortgage environment offers buyers clarity, transparency, and multiple financing pathways. By understanding interest structures, market benchmarks, and personal financial goals, buyers can move forward with confidence.

Before finalizing any home loan, take time to compare options, use reliable calculators, and seek professional guidance when needed. A thoughtful mortgage decision supports not just home ownership, but long-term financial peace of mind.